Private Equity value creation in a challenging environment

In today's challenging macroeconomic environment, Private Equity firms must adopt a structured, integrated approach to value creation. Success increasingly depends on carefully orchestrating operational, strategic, and financing levers tailored to each portfolio company. A survey with 50+ Private Equity firms confirms: Operational value creation is becoming the top priority, especially driving profitability through operational, organizational, and commercial excellence.

Scroll down

Shift to operational and strategic value creation levers

In today's persistently challenging macroeconomic environment, Private Equity (PE) firms are increasingly turning to operational value creation as a primary source of sustainable and enhanced investment returns. At Fortlane Partners we analyzed a recent survey with over 50 operating partners and managers from leading European Private Equity firms, evidently there is a clear shift in focus. The traditional reliance on financial engineering is being supplemented – and in many cases, overtaken – by operational and strategic value creation levers.

This shift is largely driven by a series of macroeconomic challenges, including slowed GDP growth, rising interest and inflation rates, geopolitical volatility, supply chain constraints, foreign exchange fluctuations, and acute shortages of skilled labor. These conditions have intensified the need for Private Equity firms to create value within their portfolio companies instead of relying on favorable debt markets or multiple expansions.

The growing importance of operational and strategic value creation

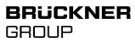

Value creation in Private Equity can be segmented into three primary categories: operational, strategic, and financing (see figure 1). While all of these lever categories contribute to equity value growth over the holding period, with the operational dimension becoming an increasingly important part of value creation strategies.

According to the survey results, 90% of respondents are actively increasing their influence and pressure on portfolio companies to achieve operational and strategic value creation. This reflects a notable change in how Private Equity firms are adjusting their playbooks in response to prolonged economic uncertainty. Looking ahead, 40% of respondents anticipate an increased contribution from operational levers, which will account for an average of 57% of the total value created during the holding period.

To meet the increased demand for operational value creation, Private Equity firms are strengthening their internal capabilities. According to the survey, 75% of Private Equity firms are expanding their operations teams, focusing on bringing in specialized functional experts and generalists.

Core priorities for operational value creation

In response to today’s volatile macroeconomic conditions, Private Equity firms are reevaluating the importance of levers for creating operational value. While topline growth and profitability levers were historically prioritized similarly, the survey indicates a notable shift: 66% of Private Equity firms currently emphasize profitability levers, compared to only 51% emphasizing topline growth. This shift signals a subtle yet significant pivot toward cost optimization and operational efficiency as firms adapt to tighter margins, inflationary pressures, and elevated financing costs.

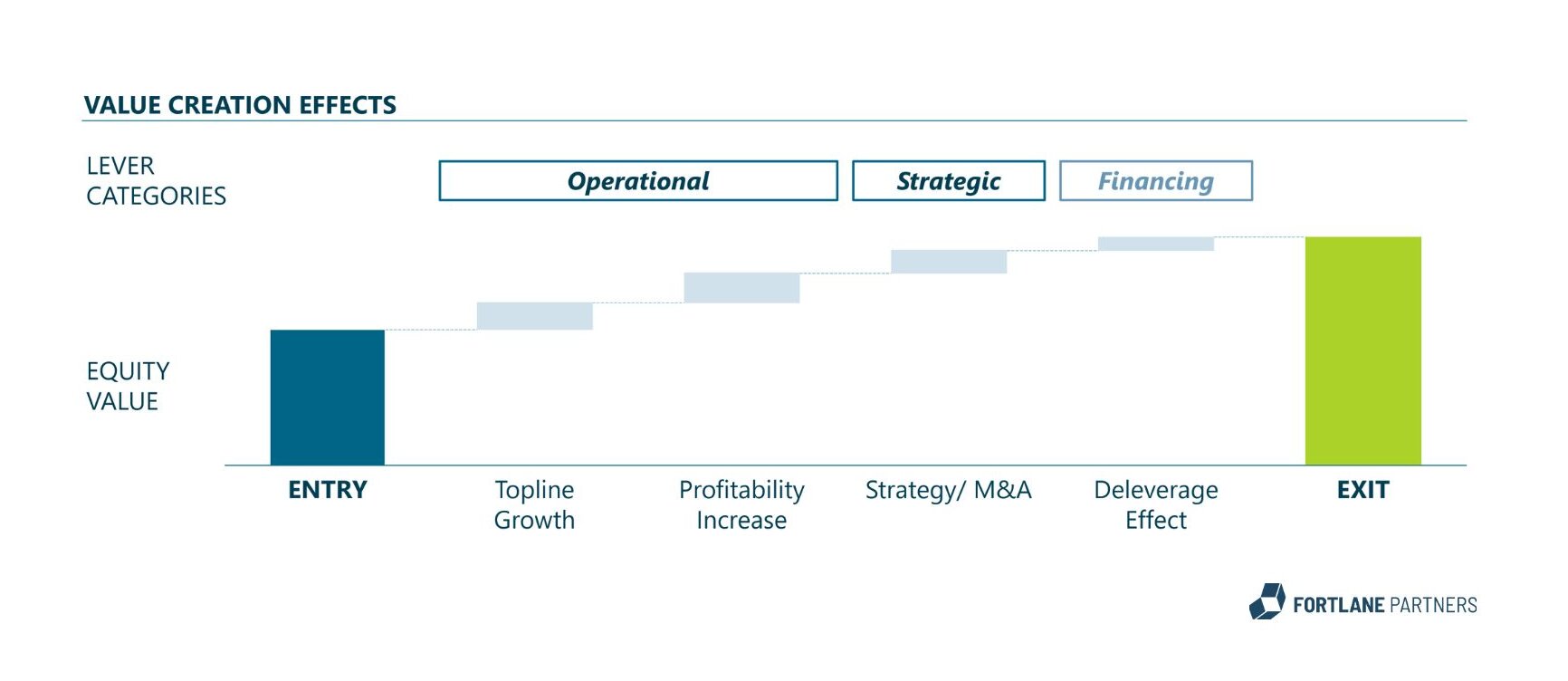

However, the ability to tailor the strategic focus to the unique characteristics and performance profile of each portfolio company remains the most critical factor in value creation success. In today’s complex environment, a “one-size-fits-all” approach is increasingly inadequate. Our experience demonstrates that effective value creation is grounded in situational diagnosis and execution agility. Underperforming or distressed assets often require turnaround strategies, including liquidity stabilization, working capital optimization and rapid cost reduction. In contrast, stable and mature companies benefit from initiative programs focused on operational and commercial excellence. High-growth companies, on the other hand, require strategies that enable scaling capabilities, building a robust organization and digital transformation (see figure 2).

Ultimately, value creation levers must be selected, prioritized, and applied strategically, aligning with the company’s maturity stage, sector dynamics, and performance trajectory. Private Equity firms that apply this differentiated approach will be better positioned to drive sustainable value creation.

Our comprehensive value creation framework

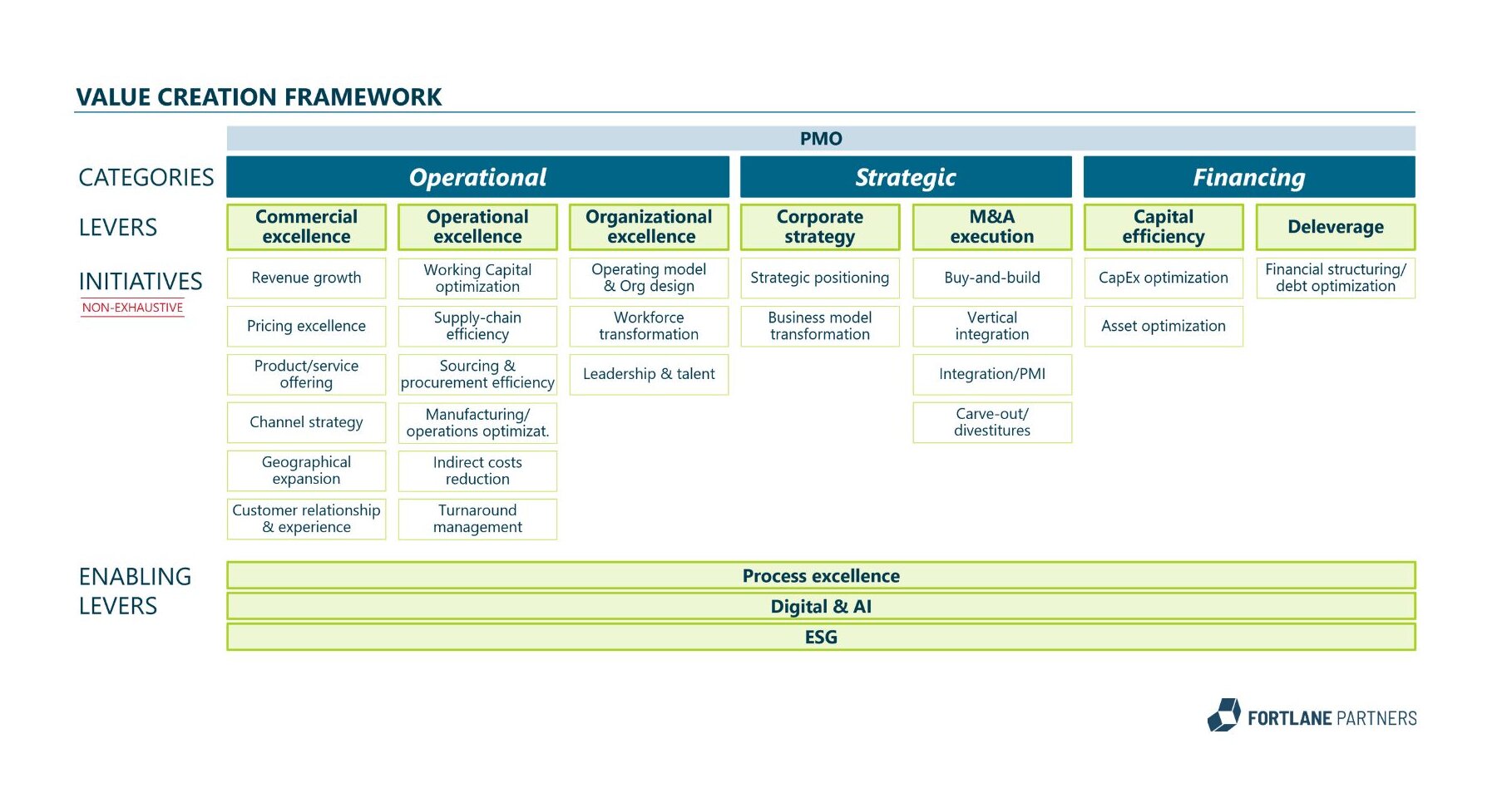

To meet the evolving demands of today's macroeconomic and investment environments, we have designed a comprehensive value creation offering to address the full spectrum of value creation lever categories – operational, strategic, and financing. This integrated approach allows Private Equity firms to drive measurable improvements in portfolio company performance throughout the holding period and maximize investor returns at the exit.

The Fortlane Partners value creation framework includes the following levers (see figure 3):

- Commercial excellence

- Operational excellence

- Organizational excellence

- Corporate strategy

- M&A execution

- Capital efficiency

- Deleverage

These levers are further amplified by cross-functional, enabling levers such as Process excellence, Digital & AI and ESG that can create a double impact by improving operating margins and enhancing valuation multiples through stronger business model narratives and increased appeal to institutional investors.

While Private Equity firms continue to develop long-term internal capabilities, such as operations teams and board-level placements, external advisors are playing an increasingly critical role in value creation. According to the survey, 80% of respondents consider external consultants to be (very/ extremely) important for achieving value creation objectives.

This reflects a broader recognition of the specialized capabilities that external advisors bring, especially in high-impact and time-sensitive scenarios. The survey respondents highlighted three core areas where external support is most valuable:

- Identifying and defining value creation opportunities: Bringing outside-in perspectives and benchmarking insights to uncover untapped value creation potential

- Detailing, quantifying, and prioritizing initiatives: Translating high-level opportunities and levers into actionable, measurable initiatives aligned with strategic ambition and investment theses

- Implementing and accelerating execution: Driving disciplined implementation of initiatives with expert teams, tools, and change management methodologies

By integrating these external capabilities into their operating models, Private Equity firms can achieve faster time-to-impact and reduce execution risk – ultimately delivering superior returns in an increasingly competitive and complex investment environment.

Summary

In today's challenging macroeconomic environment, Private Equity firms must adopt a structured, integrated approach to value creation. Success increasingly depends on carefully orchestrating operational, strategic, and financing levers tailored to each portfolio company's specific performance profile and executed with precision.

The survey confirms a shift in the industry: Operational value creation is becoming the top priority, especially driving profitability through operational, organizational, and commercial excellence levers. Besides operational, strategic and financing levers, firms that incorporate additional enabling levers, such as process excellence, digital & AI and ESG, enhance not only their margins, but also their valuation multiple, thereby future-proofing their company.

Furthermore, the survey shows a consensus among Private Equity firms that, to maximize returns and fully unlock value creation potential, internal capabilities must be combined with external expertise.

Contact us to learn more about our value creation framework, detailed use cases, and how we partner with leading Private Equity firms to deliver measurable, lasting results for their portfolio companies.

ContactGet in touch