The end of telco stores?

Future scenarios for the telecom sector's retail footprint.

This publication dives into the short-term actions that telcos need to take in order to successfully ramp up their physical stores after the COVID-19 pandemic, but also which three main scenarios they should consider for their long-term retail strategy.

Scroll down

The current global pandemic and its implications highlight the tremendous importance of telecommunications companies – and the industry is momentarily operating at full capacity. But still, this does not hide the fact that the telecommunications landscape has been under pressure for many years – especially due to an ongoing rise of OTTs. Additionally, increasing 5G investments urge the industry to reduce operating costs to a large extent. Forced to transform, telcos worldwide are carefully evaluating the sustainability and impact of their retail footprint. For example, AT&T has started a cost-cutting program to trim $6 billion by 2023 that strongly focuses on their retail operations1.

Against a background of the rise in customer demand for a seamless switch between online and offline sales channels, telcos have started to adapt their customer approach by strengthening their digital customer engagement and by implementing a new digital-lead omnichannel mix. As customer expectation on proximity, simplicity, and convenience will undoubtedly continue to rise, digital channels will even further increase in popularity and importance.

Nevertheless, despite being a major cost bucket – physical sales channels are still one of the most important revenue drivers. But what happens if external events render physical sales channels useless over night?

Retail challenges and opportunities

The COVID-19-pandemic has had a severe impact on telco companies’ retail footprint. According to Fortlane Partners market observation, approximately 85% of telecommunication shops in Germany were shut down during the crisis – the remaining 15% operated at limited opening hours. Since COVID-19 forced customers to rely on online channels, the pandemic has probably been the strongest accelerator of sales channel digitalization. After weeks of lockdown, the short-term focus is now on reopening of the physical stores. At the same time, the current momentum – the increased change in customer behavior – provides the opportunity for telcos to actively rethink the long-term impact and the required strategic adjustments of their retail footprint.

Telcos and their top executives are now faced with two urgent challenges:

- What short-term measures are required to ramp-up my shops again?

- How are overall customer behavior and interaction, as well as footfall in shops changing in the long-run, and what is the implication on my future retail footprint?

Short-term measures for ramp-up

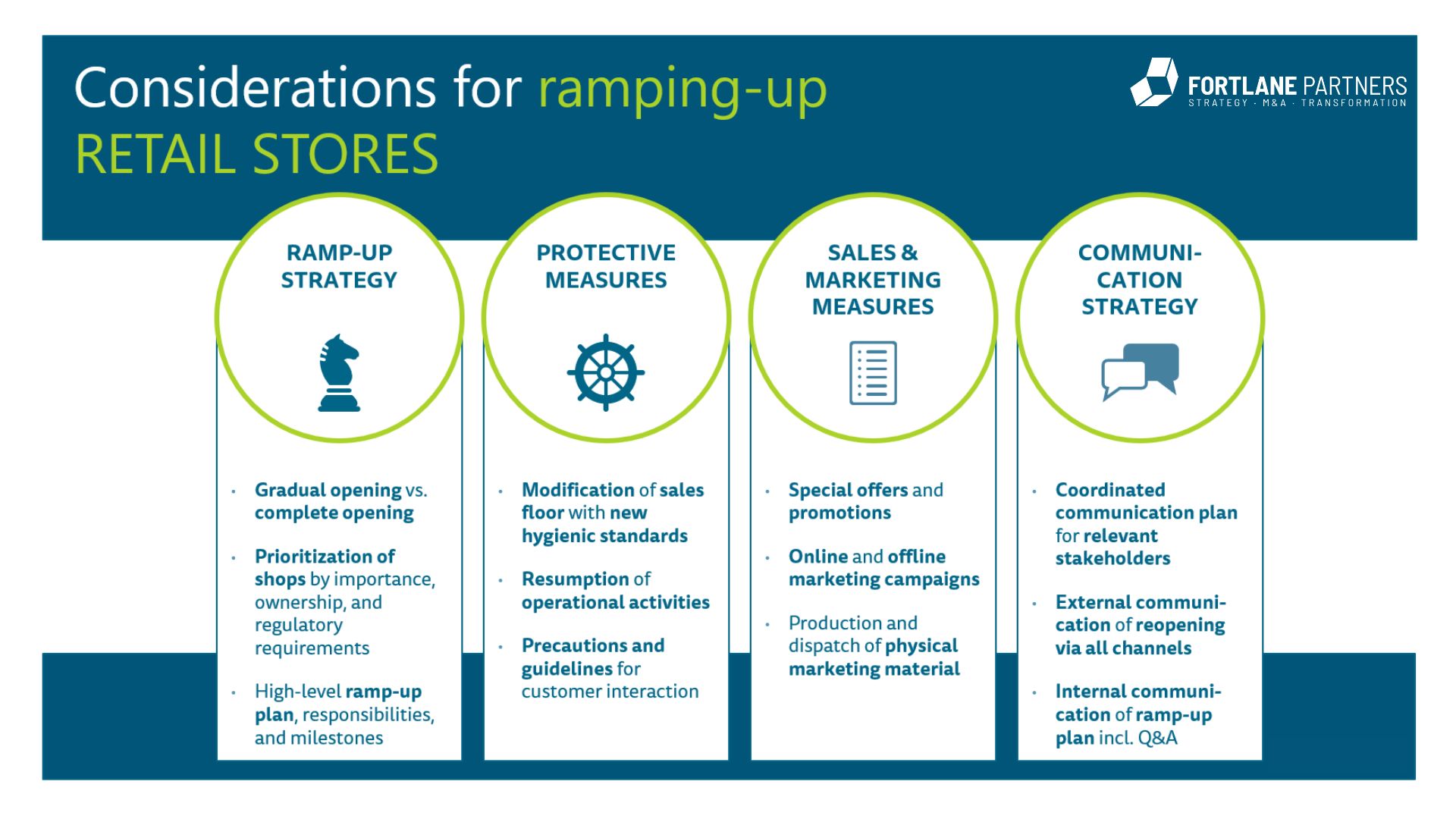

To reopen shops in the short-term, telcos should define a ramp-up strategy, orchestrate organizational and hygienic preparations, implement sales and marketing measures, and follow a consistent communication concept. Along the four pillars below, telcos need to answer four key questions.

- Should the focus be on gradually reopening the shops or should all shops be reopened at once?

- What protective measures have to be implemented to ensure safety of employees and customers and fulfill legal requirements?

- How can customers be attracted to come back to the store? How can the reopening be promoted?

- Who are the key stakeholders to be addressed with a uniform communication?

Long-term implications on retail strategy

Reopenings and short-term actions aside, telcos urgently need to think about long-term implications on their retail footprint due to changing customer behavior, customer interaction, and footfall.

Evidently, external events have a strong impact on telcos’ retail footprint. The COVID-19-pandemic radically stopped physical customer interaction and shopping experiences by forcing telcos to close their shops. At the same time, customers had to switch to digital channels to an even greater extent. In this regard, the key questions for top executives are:

- How disruptive will the adapted customer behavior and shopping patterns be?

- How fast will this change continue and, as a result, will footfall pick-up again once shops are reopened?

- How profitable will it be to operate shops – as they are right now – in the future?

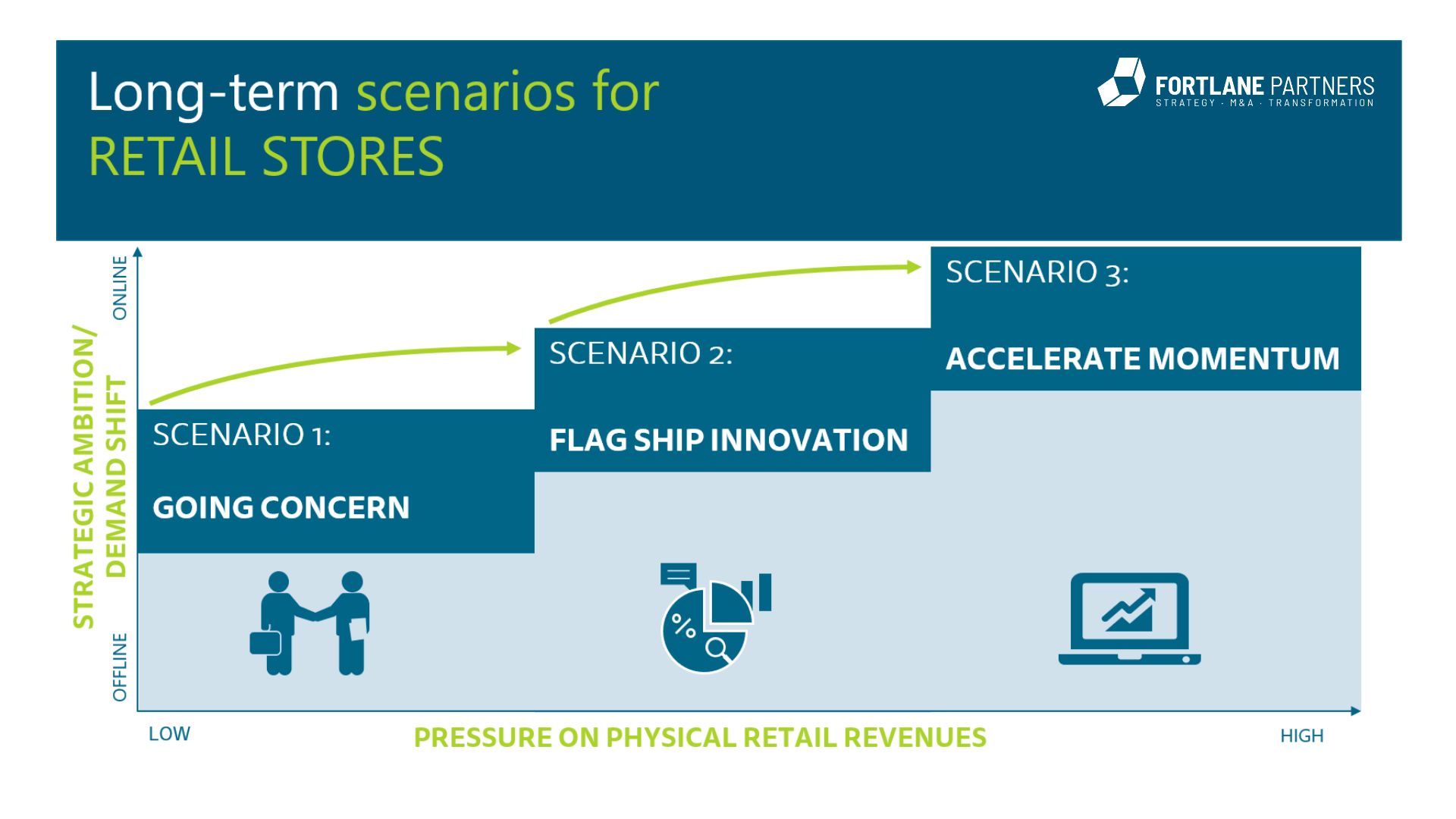

This challenging situation is giving telcos a unique opportunity to use the momentum to drastically change their overall retail and sales channel strategy. By innovating their sales channel mix and retail footprint, telcos will be able to fulfill customer needs on- and offline, as well as improve operating costs at the same time. Without a doubt, the unpredictability of the pace of customer demand shifting online entails certain risks to consider. Nevertheless, it is a unique opportunity for telcos to use the momentum and accelerate “digital first”. Telcos disregarding these disruptive forces will not only seriously damage their competitive position in the medium-term but also miss the chance to prepare for long-term growth and future competitive advantage. Combining both, external drivers on retail and strategic considerations by top management, telcos should explore different scenarios (see below) to successfully manage the future development of their shops and retail stores. Balancing the retail footprint strategy with the change in customer behavior is key to staying competitive. Potential measures such as the selective closure of non-performing shops and sticking to strategic locations and/or flagship stores will enable telcos to keep risks at a moderate level. At the same time, telcos should strengthen their digital capabilities to benefit from the momentum, and to be able to provide an improved customer omnichannel experience. Digital excellence will be key to cater to the changing customers behaviors in a long-lasting and sustainable manner.

Summary

Act short-term, think long-term

To successfully and responsibly reopen shops in the short-term, telcos need a clear ramp-up strategy. At the same time, the overall retail strategy and long- term planning will definitely result in required adjustments of the physical retail footprint. Therefore, telcos need to be prepared to act early and decisively.

Since many locations have long-term rent commitments, thinking about innovative shop concepts and alternative utilization of stores should be part of retail footprint considerations. Developing a clear view on store performance, impacted retail costs and revenues and embracing the shift in customer behavior at the same time will lead to a competitive advantage when it comes to deciding and executing the “right” measures to drive the future of retail.

Sources: Fortlane Partners; 1 Lightreading, 2020; 2 Customerthink, 2020

ContactGet in touch