Digital infrastructure value creation – what’s next?

In a world where connectivity is king, digital infrastructure is the backbone of our digital age. From telecom towers to data centers, these assets are not just stable investments – they’re essential. As we look to the future, the next wave of growth and efficiency in this sector promises to unlock unprecedented opportunities. Dive into our article to discover how strategic innovation is set to redefine the landscape and deliver exceptional returns.

Scroll down

Current status of the digital infrastructure landscape

The digital infrastructure landscape is evolving rapidly, driven by technological innovation and increased demand for connectivity. Digital infrastructure, including telecommunications towers, fiber networks, and data centers, has emerged as a highly attractive asset class due to its low cyclicality and stable returns. These assets provide the backbone for modern digital services, ensuring their continued relevance and importance.

- Investment environment: The market for digital infrastructure has experienced a surge in investment activity due to its rising attractiveness as an asset class, with private equity firms and infrastructure funds showing increased interest. Existing data highlights this trend, with deal volume growing significantly since 2018, reflecting strong investor confidence. However, the recent underperformance of selected fiber assets led to a general worsening of investor sentiment and resulted in a slowdown of investment activity from 2022 onwards.

- Recent deals: Notable transactions in 2023 and 2024, such as Cellnex's acquisitions in Europe and American Tower’s investments in emerging markets, underscore the ongoing consolidation and strategic repositioning within the industry. These deals highlight the continued interest of investors in digital infrastructure and the potential for further growth.

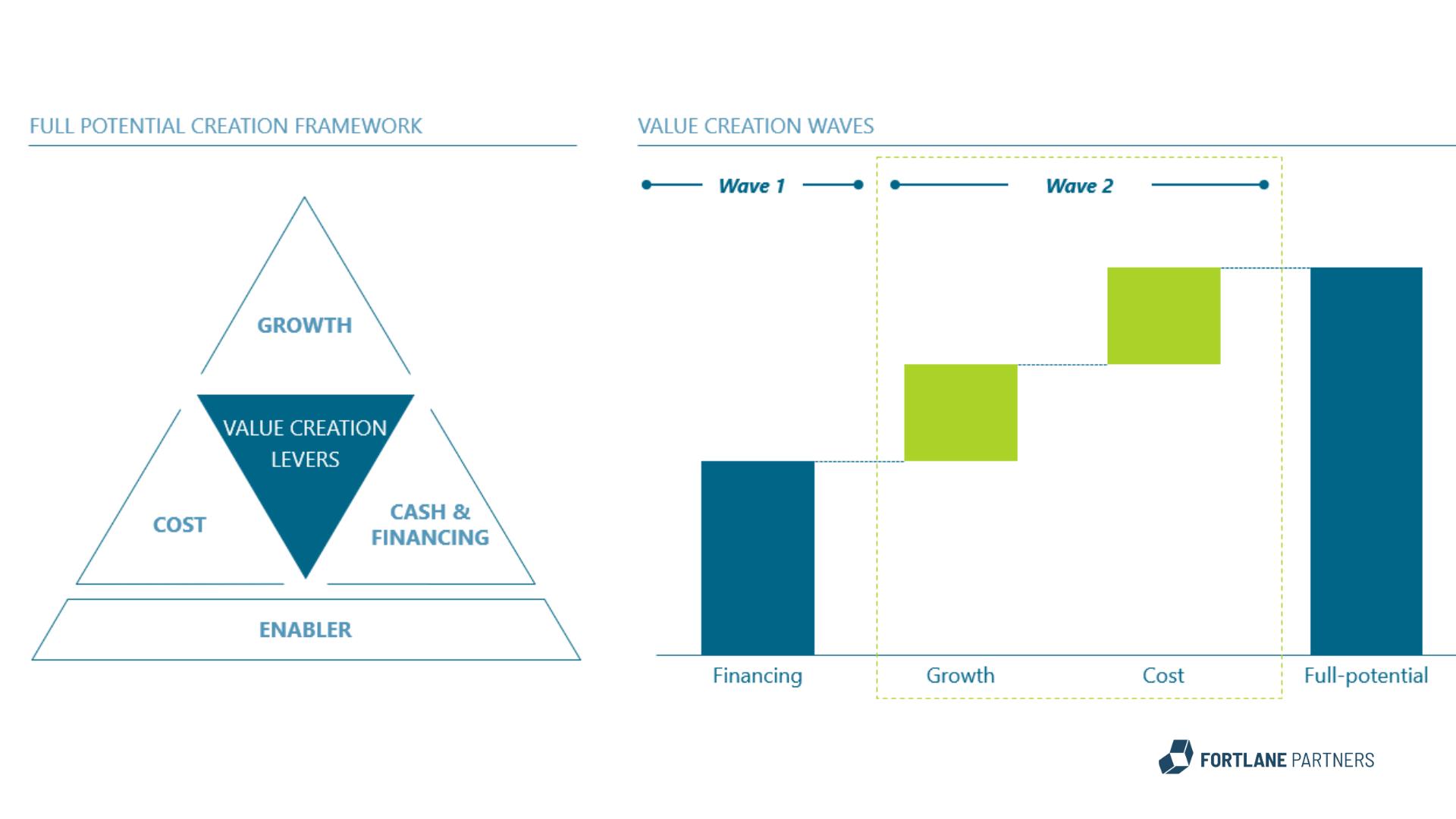

- Full-potential framework: To further drive multiple expansion for their portfolio companies, investors need to focus on value creation. Our full-potential value creation framework encompasses three-core levers for value creation: Cash and Financing, Growth, and Cost, as depicted below.

Leveraging the 2nd wave of value creation is key.

Wave 2: Value creation for digital infrastructure assets

Lever 1: Growth & sales excellence

The first lever in the second wave of value creation will focus on growth, with digital infrastructure companies exploring various strategies to expand their revenue streams and enhance market reach.

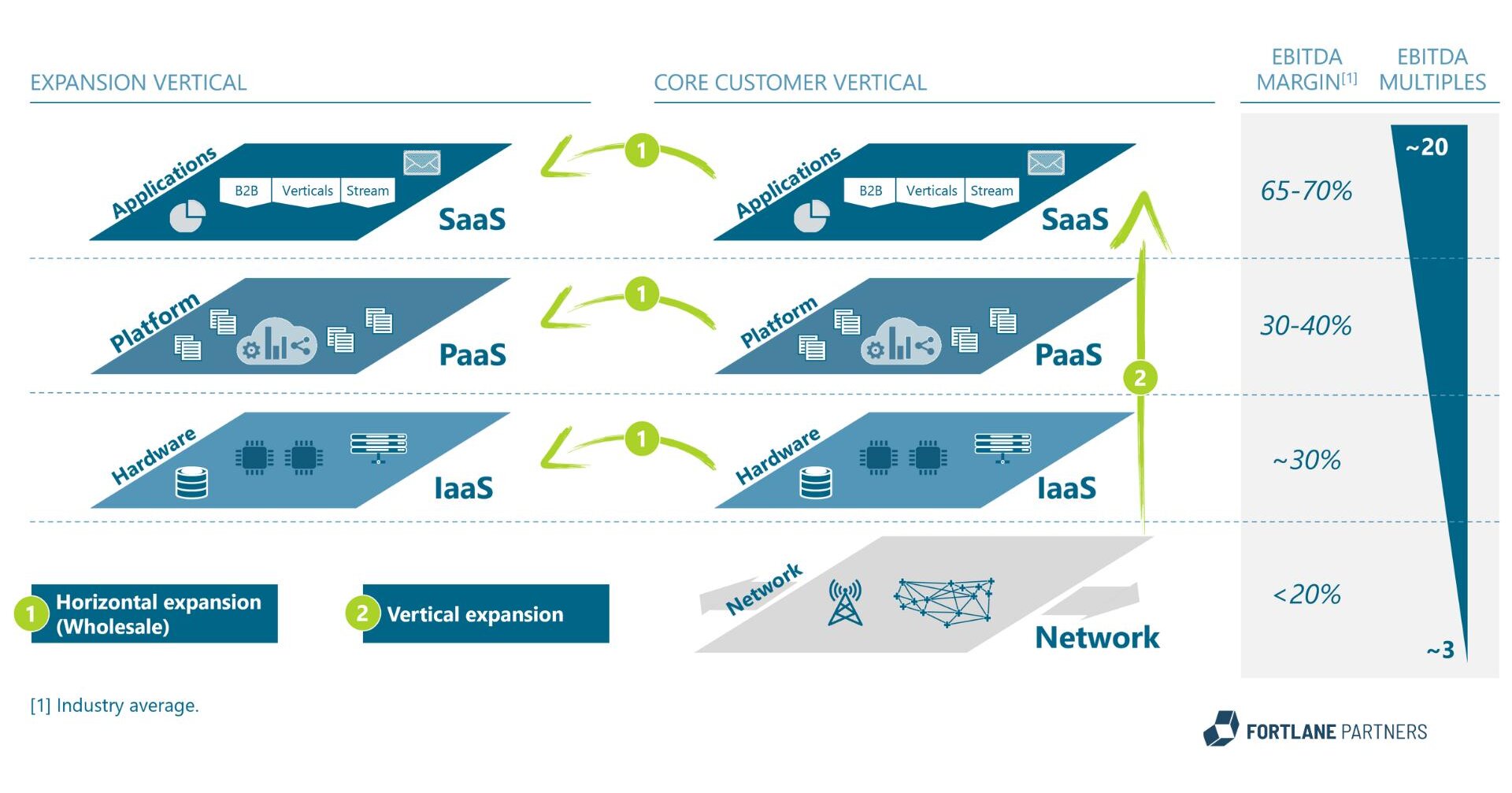

One approach to driving growth is through horizontal expansion, which involves diversifying revenue streams by leasing infrastructure to non-mobile network operator companies and maximize utilization. For instance, TowerCos can lease space to broadcasters, emergency services, IoT companies, and other sectors that require reliable communication infrastructure.

By doing so, these companies can tap into new customer segments, reduce dependence on traditional telecom customers, and enhance asset utilization.

An example for this horizontal expansion was a major TowerCo that diversified its customer base by leasing space on its towers to smart city initiatives. These partnerships enabled the TowerCo to provide infrastructure for smart lighting, surveillance, and environmental monitoring, thereby expanding its revenue streams and aligning with urban development trends.

Another strategy for growth is vertical expansion, which involves introducing new services, products and technologies to existing and new customers. Digital infrastructure companies can insource active network layers to provide connectivity-as-a-service or offer Platform-as-a-Service (PaaS). With deep integration they can combine offerings to Everything-as-a-Service (XaaS) solutions consisting of comprehensive packages that include connectivity, data analytics, and cloud integration.

Additionally, deploying small cells and Distributed Antenna Systems (DAS) can enhance network coverage and capacity, particularly in urban areas and large venues. The ongoing roll-out of 5G networks presents significant opportunities for vertical expansion, as it requires denser and more advanced infrastructure.

As customer demands specialize, digital infrastructure companies need to offer a higher degree of customization. This can include offering customized solutions, such as tailored connectivity packages for different industries, or developing new tailored services that leverage the capabilities of advanced infrastructure.

For example, TowerCos could offer advanced analytics and monitoring services that help customers optimize their network performance. Data centers could provide enhanced security and compliance features to meet the needs of industries with strict regulatory requirements.

To accelerate innovation, forming strategic partnerships with technology companies, service providers, and other stakeholders can additionally enhance the value proposition of digital infrastructure companies. These partnerships can lead to the development of new products and services, improved operational capabilities, and access to new markets. By collaborating with other players in the ecosystem, digital infrastructure companies can create more integrated and comprehensive solutions for their customers.

A potential strategic partnership could be a TowerCo partnering with a technology firm to develop IoT solutions for smart cities, which could provide not only the infrastructure but also the software and analytics tools needed to manage smart city applications.

This comprehensive offering would enhance the TowerCo's value proposition and position it as a key enabler of smart city development.

Lever 2: Efficiency & operational excellence

The second lever, operational excellence, is critical to sustain profitability and enhancing asset value in the digital infrastructure sector. Companies must focus on optimizing their operations, reducing costs, and improving asset performance.

Energy costs are a major component of operational expenses for digital infrastructure companies. Implementing energy-efficient technologies and optimizing energy procurement can lead to substantial cost savings.

For example, installing photovoltaic (PV) systems combined with Battery Energy Storage Systems (BESS) can reduce reliance on grid electricity, lower energy costs, and contribute to sustainability goals. These measures are particularly relevant as energy prices continue to fluctuate and environmental regulations become stricter.

By centralizing cost-relevant departments, organizational structures can be streamlined, and internal efficiencies and economies of scale can be realized. This can be the first step to build a future ready operating model.

Further steps can include leveraging advanced technologies such as AI and automation to optimize network rollout, streamline site acquisition, and enhance infrastructure efficiency. Additionally, implementing robust lifecycle management practices will help extend asset longevity, reduce operational costs, and ensure scalability to meet future demands.

Another critical area for operational efficiency is predictive maintenance. By using digital twins – virtual replicas of physical assets – companies can monitor the condition of their infrastructure in real-time and predict when maintenance is needed.

This approach allows for proactive maintenance, reducing downtime, minimizing service disruptions, and extending the lifespan of assets. Automation of maintenance processes can further streamline operations, reducing manual errors and optimizing workforce deployment.

An exemplary case was a leading data center operator that implemented digital twin technology and saw a significant reduction in downtime and maintenance costs. By predicting potential failures before they occurred, the company was able to schedule maintenance activities more effectively, improving asset reliability and customer satisfaction.

Through the addition of service layers on top of the core network layer, additional high margin value streams can be created. Further, the additionally created services layers can be adapted and sold to additional customer verticals.

Summary

The next wave of value creation in digital infrastructure is not just an opportunity – it's an imperative. Companies that act now will capture the growth and efficiency gains that others will miss, setting themselves apart in a rapidly evolving industry. By seizing this moment, digital infrastructure companies can unleash new potential, secure a commanding competitive edge, and drive exceptional returns for investors. In an industry that rewards bold moves, the time to lead with strategic focus, innovation, and excellence is now.

ContactGet in touch