Insight

Study

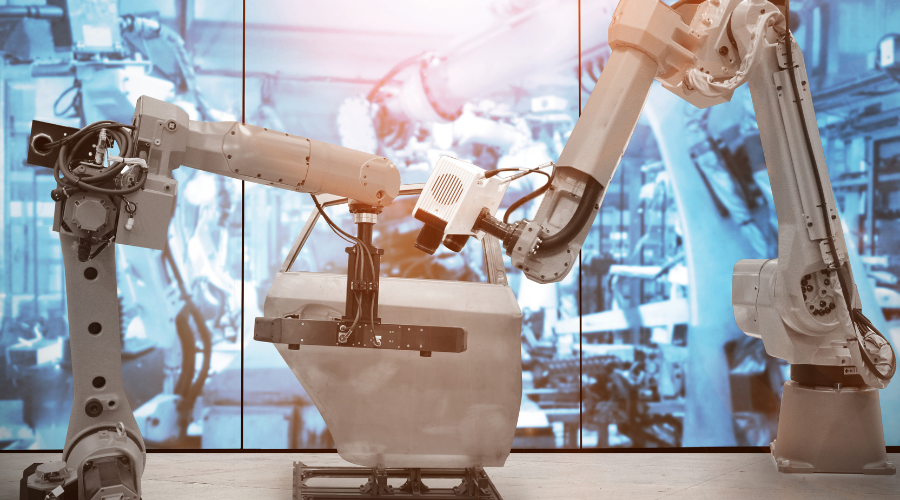

Value creation for industrials in Europe 2023

Industrial companies have experienced tailwinds in recent years, with the industrial machinery and components sub-sector performing particularly well, delivering above-average total shareholder returns. Learn more about which value drivers and success factors make companies real champions in our new study.

Value Creation and Exit Readiness

Performance Improvement

Industrials and Automotive

Scroll down

ContactGet in touch

Felix von Obernitz

Value Creation and Exit Readiness, Carve-out and PMI, Strategy and Growth, Principal Investors and Private Equity, Industrials and Automotive