Making telco business models future-proof

Platform businesses have been the trailblazers of the early 21st century.

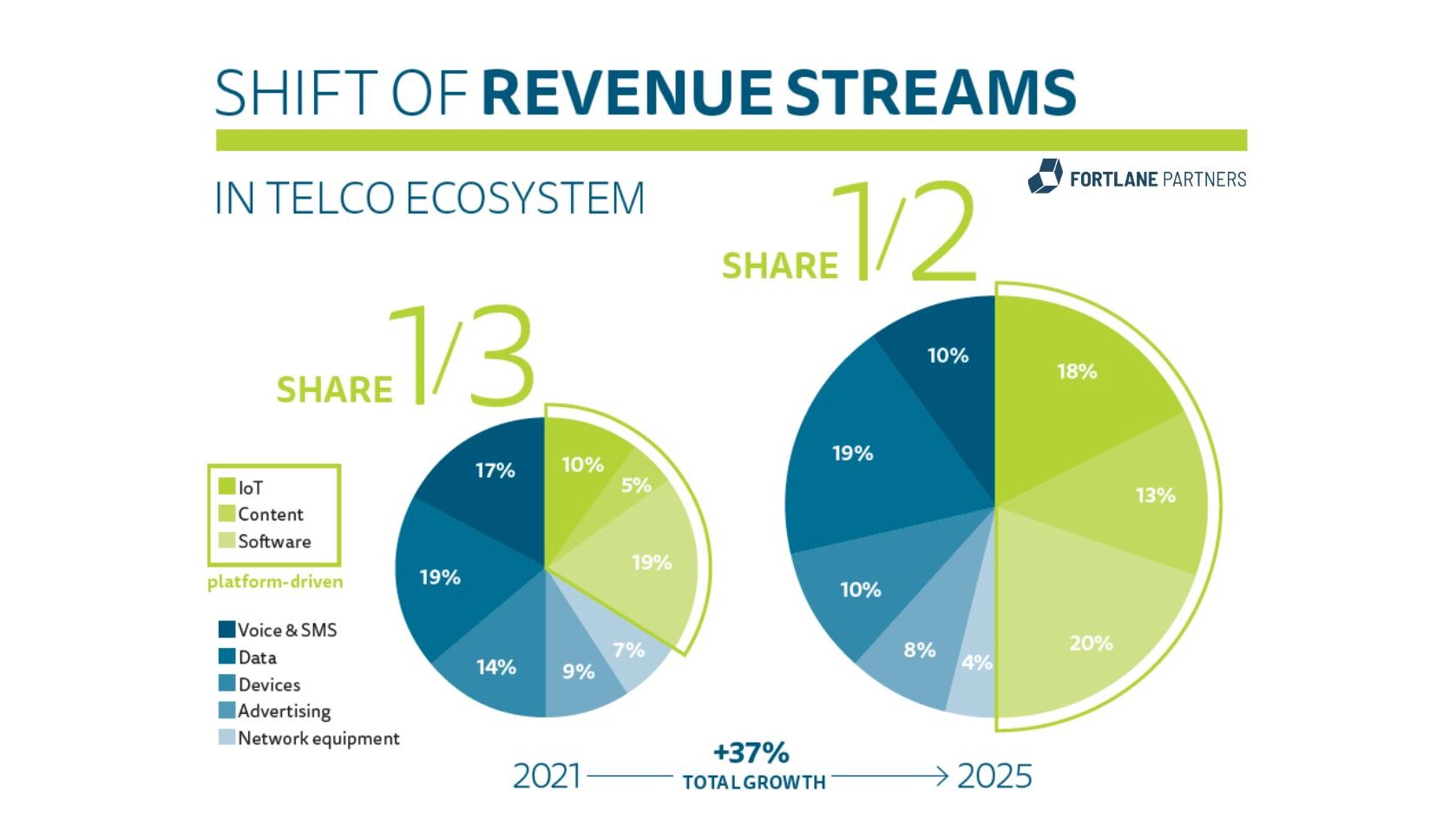

Fueled by technological advances and ever-deepening pools of data, digital platforms have already successfully disrupted numerous industries. Telcos missed out on early opportunities and have seen the revenue streams of the telco ecosystem shift in the process. They must act now. Platform business models have reached the telco industry –

and they are here to stay.

Scroll down

A digital platform is more than just technology. It is a business model based on the concept of a multisided digital framework that redefines the way participants interact with one another. It radically reduces transaction costs and/or facilitates innovation within industries. With traditional value chains under pressure, companies are making platform business models a priority and a strategic decision for growth and long-term business viability.

In the past, many telco companies missed out on the opportunity to become a first mover and to create digital ecosystems and partnerships early on. Instead, they mainly kept their focus on building the required infrastructure and on monetizing connectivity services in line with the traditional telco value chain. But while data volume is continuously growing and consumers are demanding higher connectivity, customer willingness to pay is declining. The role of simple connectivity providers is no longer sufficient to be profitable and competitive. The same is true for infrastructure, an area that is also becoming a less relevant differentiator – with the constraint of high capex investments in addition.

Instead, the telco ecosystem is rapidly shifting toward new, increasingly important revenue streams. Providing customer value in the realm of IoT solutions, media content and software applications will make the difference and will generate the new business and revenues that telcos need. For this reason, they must now leverage their access to telco customers (B2B, B2C) and key (technology) partners to position themselves as ecosystem enablers. Only then, telcos will be able to make their business model future-proof and play a crucial role in innovating industries such as healthcare, heavy industry and everything regarding smart-city infrastructure.

Key considerations for platformtransformation

The following key considerations have gained momentum and put telcos in a position that makes platform business models the inevitable next step:

- Positioning: The large customer base maintained by telecos and their etworks will enable them to become digital service enablers by curating and orchestrating services that use their own platforms. By taking this approach, they can turn the CSPs’ success into an opportunity for new revenue streams by curating verticals and orchestrating an ecosystem for multi-domain secondlevel platforms. The CSPs’ platform will become the center for other CSP and OTT services and facilitate access to other industries (e.g., digital healthcare).

- Technology: Technological advances are a key driver of the telco business. Innovating at speed is therefore an important capability to scale business along new technologies – 5G acts as accelerator for platform deployment. The migration of 5G networks is driving connectivity in B2B and B2C and the requirement for services that offer an outstanding customer experience. For example, multiaccess edge computing (MEC) offers new potential revenue streams in partnerships with hyperscaling cloud providers.

- Infrastructure: Until recent years, a telco’s infrastructure was a key competitive differentiator. Today, many transactions designed to better manage CapEx and increase operational and capital efficiency are being conducted in the telco infrastructure. This trend is prompting telcos to rethink their infrastructure1 strategy regarding a platform business model deployment and flexibly adjust it based on their target customers and industries.

- Regulation: Previous network technologies lacked a level playing field for telcos and OTTs. Telcos made the huge infrastructure investments, and OTTs benefited from them. As a result of new regulations, all competitors in the market should have more equal opportunities to monetize their infrastructure, services or platform.

1See: Fortlane Partners 2021. Infrastructure separation as a solution for mobile network operators

Becoming a platform player: one scenario

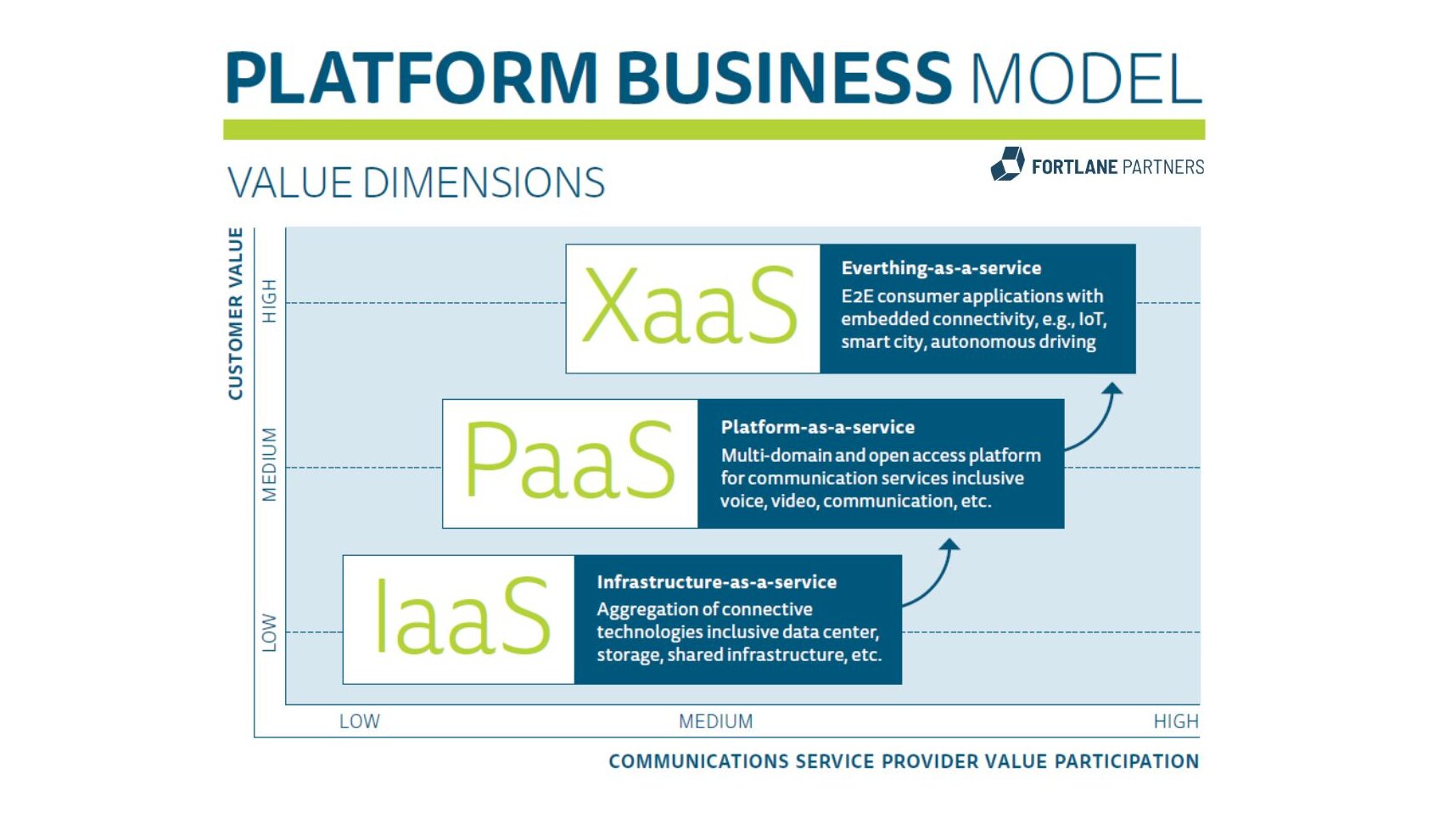

The platform business model will likely manifest itself across three layers (infrastructure, platform and everything-as-aservice) as shown in the graphic below. The key shift is the creation of a platform to provide open access connectivity to any service provider, allowing for a multitude of customer-oriented services such as IoT apps and digital healthcare solutions. This shift will become an inevitable step if telcos are to emerge and capture important growth industries. Unless telcos reinvent their business model, we expect history to repeat itself – massive amounts of CapEx will be invested and produce no discernible incremental value extraction. Furthermore, platform development is a time-intensive process bringing customers and producers together, while monetization of the platform might pick up slowly with growing number of services.

To transform a traditional value chain into a successful platform business model, five key points should be kept in mind:

Summary

The time to act is now! Leveraging current platform growth drivers combined with strong decision making is essential for telcos to be a major beneficiary of the continuous platform revolution. Unless telcos act courageously on a new future-proof business model, they will once again fail to capture market shares from digital hyperscalers.

Sources: GSMA, Fortlane Partners

KontaktSprechen Sie uns an