What it takes for telcos to unlock the market

With their growing revenue and drive to innovate, small and medium-sized enterprises comprise an attractive customer group for telecommunication providers. SMEs are looking for telco products and level of service typically offered to large enterprises but remain very budget conscious. What telcos can do to address these needs and tap this potentially lucrative market.

Scroll down

SMEs form the backbone of most economies in developed countries due to their overall numbers and economic impact. They represent about 90% of businesses worldwide and generate about 50% of global GDP1 as well as drive innovation and competitiveness in their respective industries. SMEs enjoy strong positioning on national and international markets, which contributes to their stable and growing revenue.

Companies in this segment also have one priority in common with large enterprises: digital transformation. SMEs exhibit a wide range of digital maturity, with the majority requiring services that extend beyond mere connectivity to include, for example, data analytics, cybersecurity and data warehousing. Despite grappling with increasing price pressure, new market players and the commoditization of connectivity, telcos will find that SMEs represent an attractive customer segment.

Fragmented, diverse customer requirements

Identifying this customer segment as potentially lucrative is not, however, the challenge. Rather, the diversity of this segment is. The SME segment covers an abundance of different verticals, which produces very fragmented requirements involving specific consulting and product needs. Understanding these customer needs and developing suitable solutions takes time and investment. And as diverse as their requirements, so, too, are SMEs’ expectations, technological maturity and organizational setup as well as the culture of their client bases. In addition, SMEs’ relatively limited buying power and IT know-how complicate the sales process for telcos.

In the past, telcos have neglected these distinctions, often treating SMEs more like consumers while they focused dedicated sales and service resources on larger enterprise clients. This led to SMEs receiving insufficient service quality, standardized products and nontransparent pricing. SMEs expect a certain level of personalization in the sales process and bristle at the automated, self-service processes typical of the consumer business. SMEs with a more conservative company culture in particular tend to favor face-to-face sales and support. In short: SMEs want to be treated like large enterprises when offered services and products, but they also have less budget to spend.

To seize the opportunities in the SME segment, telcos must strike a balance between leveraging the standardized practices they use for the consumer segment and those they apply to the individualized enterprise market.

Striking the right balance

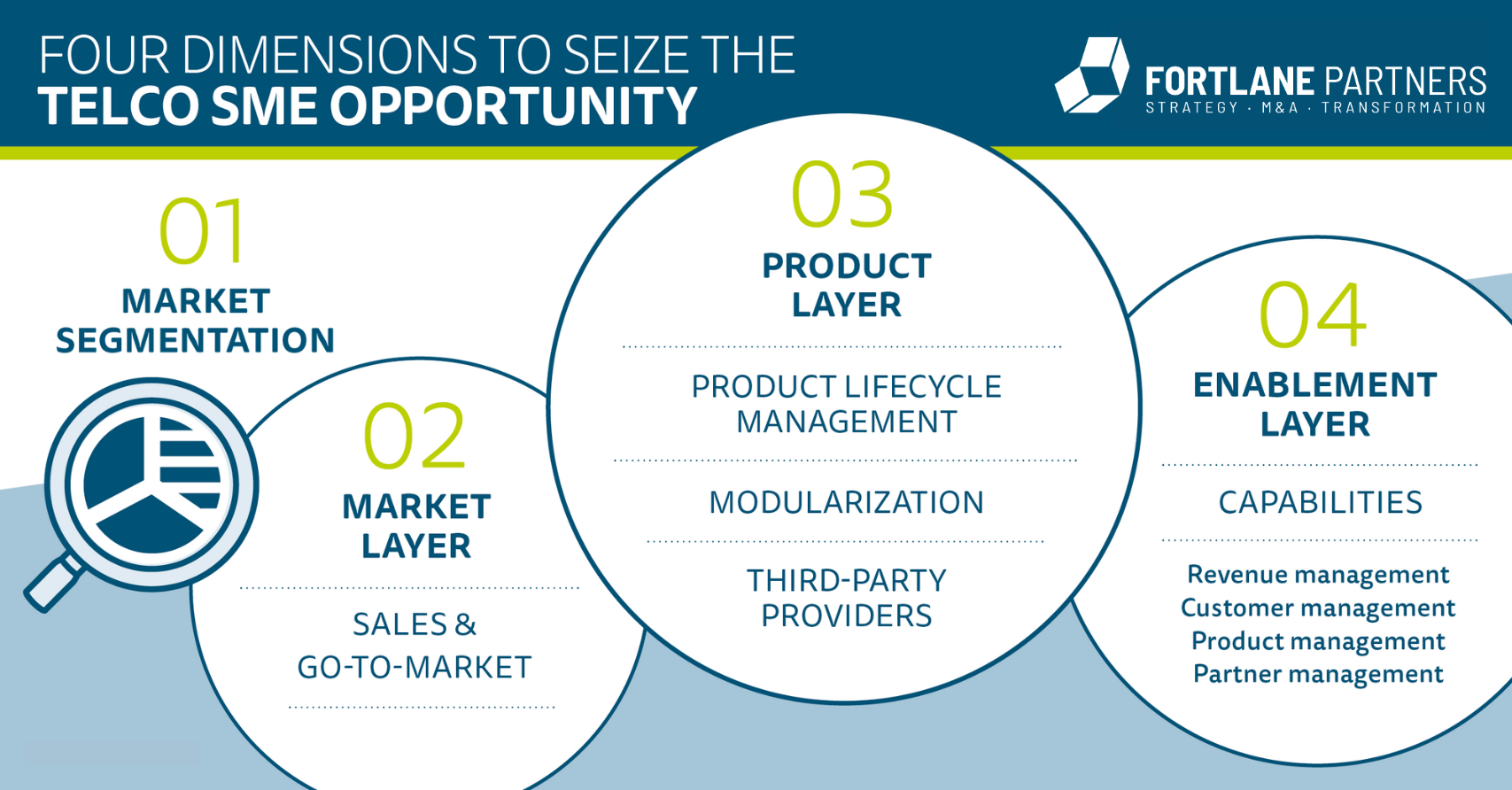

Telcos have to consider and effectively balance the following core dimensions if they are to seize the telco opportunities in the SME segment.

Summary

Telcos have so far failed to crack the SME market, having only stumbled into the abundance of different verticals that have resulted in highly fragmented SME consulting and product needs. To have an impact, telcos’ SME strategies will have to concurrently tackle the four core dimensions comprising market segmentation, market layer, product layer and enablement layer while orchestrating the complexities of their interplay.

Sources: Fortlane Partners

KontaktSprechen Sie uns an